Former treasurer Victoria Kjos, 71, sold her Phoenix home and convertible to fund a one‑way ticket east. Her journey shows that reinvention is possible long after retirement.

Once a fixture of upscale theater nights and gallery openings in Arizona, Kjos began questioning the pricey rhythm around her. “I wondered if I wanted to spend the rest of my life here,” she recalls. Soon after, the self‑described “numbers person” liquidated her assets and stepped onto a plane bound for India.

From convertible sports cars to selling it all: her pivotal 2012 decision

First, Kjos listed the house, the sporty drop‑top and nearly every possession. The proceeds—undisclosed but comfortable—became her travel budget. Who hasn’t dreamed of wiping the slate clean? By late 2012 she no longer owned property in the United States, a move that startled friends yet thrilled her.

Six‑month temple tour across India showed her money was not the only currency. Armed with a backpack and a yoga mat, the septuagenarian criss‑crossed 13 Indian states, meditating in gardens and volunteering at ashrams. The experience, she says, made her “kinder, less critical.” After India came four months in Thailand and a spell in Nepal, each reinforcing the idea that fulfillment isn’t for sale.

| Year | Location | Milestone |

|---|---|---|

| 2012 | Phoenix | Sold house, car, belongings |

| 2013 | India | Traveled 13 states, six months |

| 2014 | Thailand | Lived four months, continued yoga studies |

| 2019 | Bali | First visit, felt instant connection |

| 2022 | Bali | Permanent move on retiree residence visa |

The table squeezes a decade of decisive moves into a few lines—pretty handy, right?

Why Bali’s energy vortex convinced the retiree her search for belonging was over

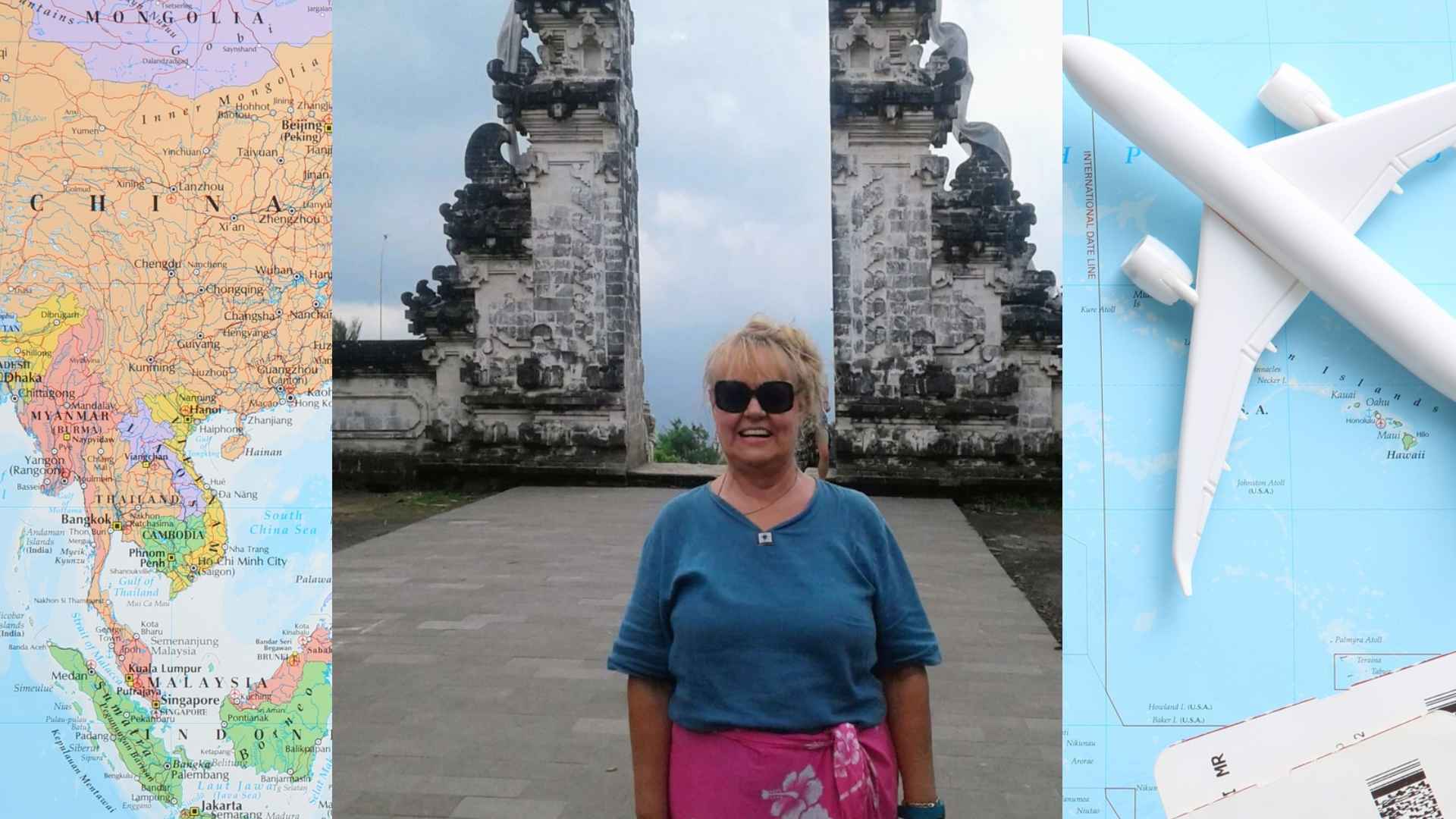

Kjos heard fellow travelers rave about Bali’s “energy vortexes.” Intrigued, she visited in 2019 and was smitten by Sanur’s calm beaches and volcano views. Some might call it wanderlust; she calls it coming home. By May 2022 she held a Kitas retiree visa and had settled into a modest apartment near the shoreline.

How other Social Security‑age Americans can follow her steps without costly mistakes? Thinking of copying her playbook? Start by tallying fixed income—from Social Security to pensions—then research long‑stay visas, health coverage and local cost of living. Below, the key tips:

- Downsize early to avoid fire‑sale prices.

- Carry digital copies of medical and tax documents.

- Visit during low season before committing long term.

- Keep an emergency fund equal to six months of expenses.

Kjos, now sipping coconut water instead of iced lattes, says the sacrifice was worth it: “I’m different—in the best way.” Her story reminds recipients of the American dream that dreams can change at any age.