Walmart has taken a decisive step in the midst of fierce retail competition by opening a 90,000-square-meter distribution center in Jacksonville, Florida. This bold move aims to strengthen the supply chain for its Sam’s Club stores across the southeastern United States, providing improved service not only in Florida, but also in Georgia, South Carolina, and Puerto Rico.

The new center comes at a time when retailers feel pressured to innovate to boost sales. Who benefits from these changes? Shoppers seeking fast, reliable deliveries can look forward to more streamlined access to Sam’s Club products. In fact, Walmart is betting that an extensive supply network will allow it to stand out from Costco, Target, and other rivals.

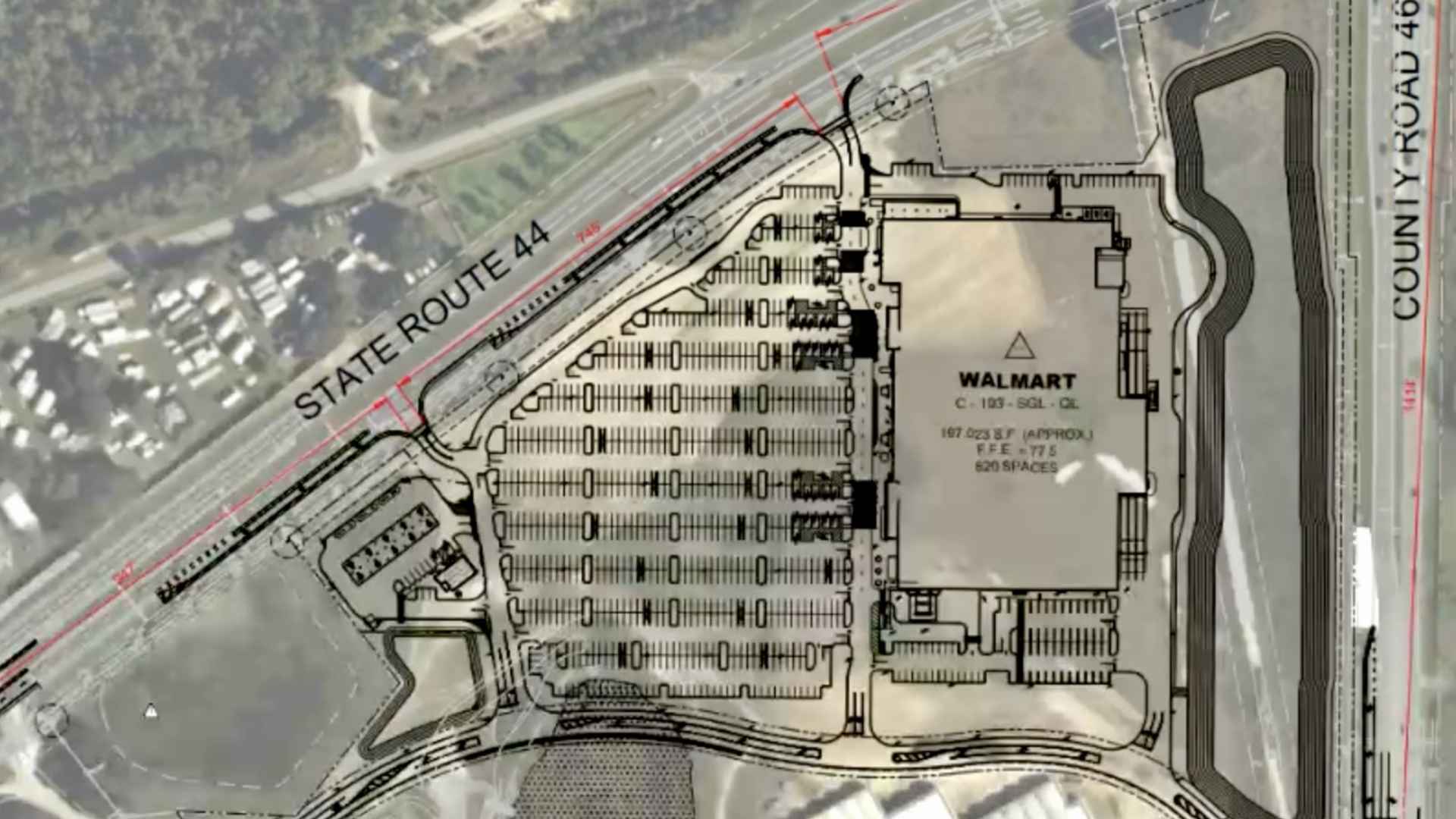

Why Walmart’s new Jacksonville distribution center could transform regional retail strategies

In recent years, Walmart has redefined itself as a customer-centric brand, placing heavy emphasis on e-commerce. To illustrate, it launched Walmart+ in 2020, mirroring Amazon Prime’s subscription model. This service quickly became popular, with members reportedly spending nearly three times more online than non-members. After observing impressive results, Walmart has chosen to ramp up logistical capacity in Florida, one of the nation’s fastest-growing areas.

Walmart’s track record includes closing a distribution center in New Jersey earlier this year, a move that raised eyebrows but reflected the brand’s willingness to consolidate operations where it sees the greatest benefits. Are you wondering what else might be in the pipeline? Some industry observers believe Walmart may continue to reorganize its logistics footprint to adapt to changing demands.

How Walmart aims to outpace Costco, Target, and other rivals through innovative expansions

Sam’s Club, which competes closely with Costco, has been central to Walmart’s strategy for quite some time. Back in 2018, approximately 10% of Sam’s Club stores were closed or converted into distribution facilities, signaling the company’s commitment to e-commerce. Now, Walmart plans to double the number of new Sam’s Club openings each year, intending to strengthen its footing in the bulk-buy market.

Below is a brief list of key states affected by the new Jacksonville center:

- Florida: Will serve as the main hub

- Georgia: Receives faster shipping times

- South Carolina: Gains improved product availability

- Puerto Rico: Benefits from expanded fulfillment capabilities

Target, meanwhile, has taken a more measured approach by developing its Target Circle 360 membership program. It hopes to retain loyal shoppers with perks reminiscent of prime-style subscriptions. However, some retailers, such as JCPenney, are having a hard time keeping up due to large physical infrastructures that can be costly to maintain.

Walmart’s distribution center in Florida underscores a strategic push to enhance supply operations, boost Sam’s Club offerings, and provide more convenient shopping experiences. Moving forward, those interested in warehouse club deals can anticipate continued expansion across key states. It is clear Walmart is determined to elevate its position against Costco, Target, and others in an ever-evolving retail landscape.