A sudden 365% increase left an elderly resident with significant financial losses and a warning for others.

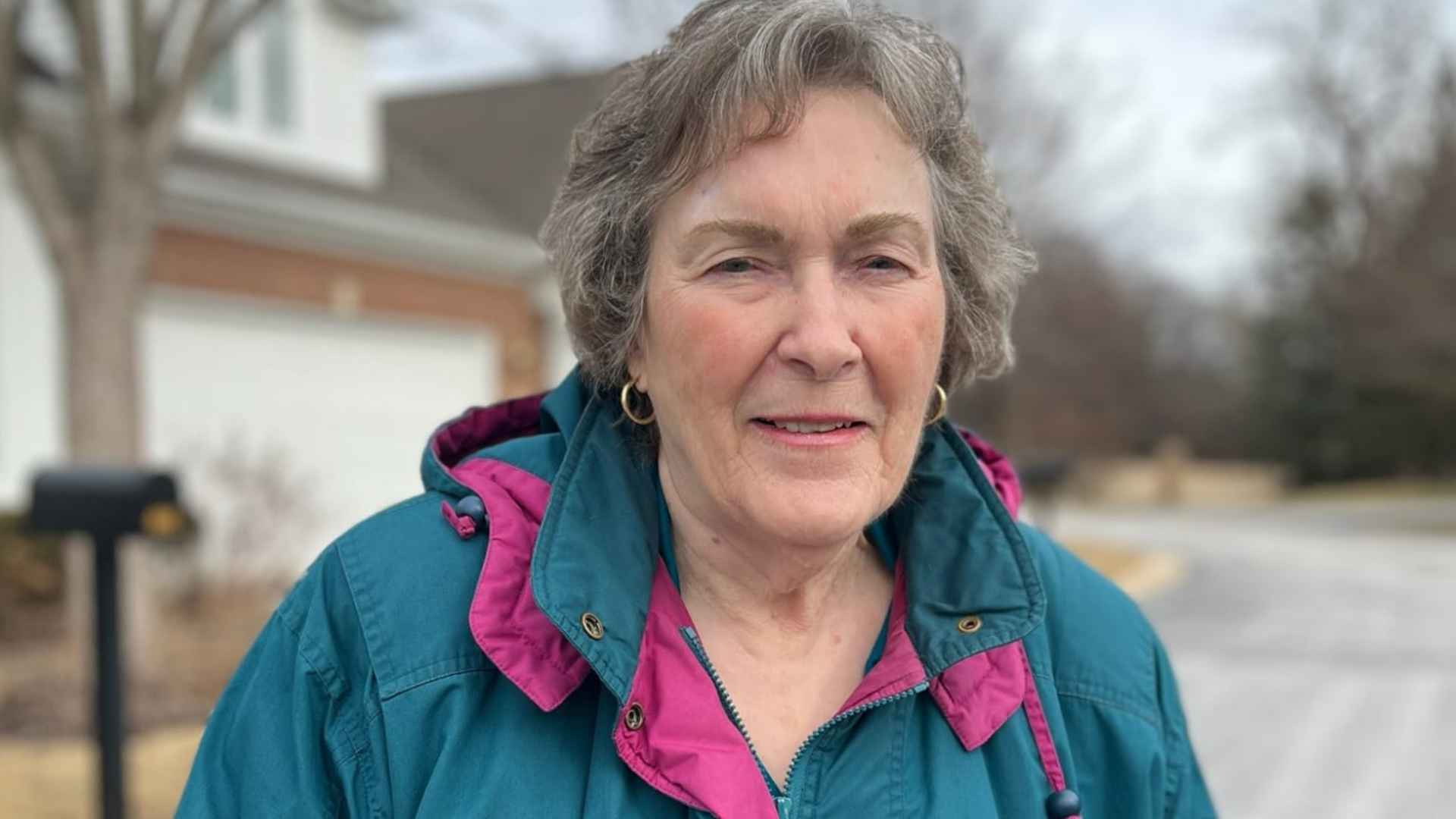

After a decade of peaceful living at River Glen of St. Charles near Chicago, Vietnam veteran Martha Bray faced a shock she never expected. Her monthly maintenance fee skyrocketed from $1,395 to $6,500, forcing her to sell and walk away from the “dream” home she had cherished for years.

Bray, 84, paid an entry fee of $314,000 in 2013 to secure a comfortable townhouse within the community. When new owners took over, they swiftly introduced steep rent hikes, turning what many seniors saw as a safe haven into a source of financial strain. Ultimately, Bray recovered just 75% of her original entry fee, estimating that the move cost her $100,000. “Your money is not safe,” she lamented, cautioning others to look carefully before signing any living contracts.

Why senior living communities are becoming targets for aggressive investment companies

Could this happen in other parts of the country? It might. As the nation’s aging population grows, senior housing facilities have become prime assets for private equity firms and real estate investors. They’re drawn by steady rental income, an ongoing need for specialized housing, and properties that can be purchased at “below replacement cost,” according to a 2025 report by a global real estate investment firm.

In 2024, at least eight of the 50 largest operators in the U.S. senior housing space were private equity–owned, as noted by the American Seniors Housing Association. These investors often prioritize profit over long-term stability, leaving residents vulnerable to sudden spikes in fees. Below is a table illustrating key figures from Bray’s case:

| Entry Fee (2013) | Original Monthly Fee | Increased Monthly Fee | Percentage Increase | Estimated Loss |

|---|---|---|---|---|

| $314,000 | $1,395 | $6,500 | 365% | $100,000 |

The table shows how drastically the situation changed, turning a once-manageable arrangement into a financial nightmare.

How seniors and their families can protect themselves against unexpected hikes

Who wants to wake up to a massive rent increase? Few people, especially older adults on fixed incomes. Experts recommend these steps before signing a senior living contract:

- Legal review: Consult a lawyer to understand fees, buy-in structures, and refund policies.

- Ownership checks: Research whether the facility is operated by private equity or traditional management companies.

- Market comparisons: Compare rent, amenities, and contract terms with other nearby facilities.

Taking these precautions can help seniors avoid abrupt financial burdens. Advocates, including the Center for Medicare Advocacy, also urge families to question any unclear fees and to document all agreements in writing.

Bray’s experience highlights the rising trend of corporate takeovers in senior living and the resulting impact on vulnerable residents. Staying vigilant about contract details, seeking legal advice, and comparing facilities can offer better protection. Meanwhile, calls for tighter regulations continue to grow as more seniors worry about the stability of their housing.