Hudson’s Bay Company (HBC), founded in 1670, has told a Delaware bankruptcy judge it can’t meet its May 3 extension to repay creditors. If no buyer appears, the doors of America’s oldest company will close for good—ending a run longer than the nation’s own history.

First up, why should you care? Current customers still hold gift cards, employees are counting on severance, and countless malls will lose an anchor tenant. In a nutshell, a piece of continental heritage is about to vanish unless a rescue plan materializes—fast.

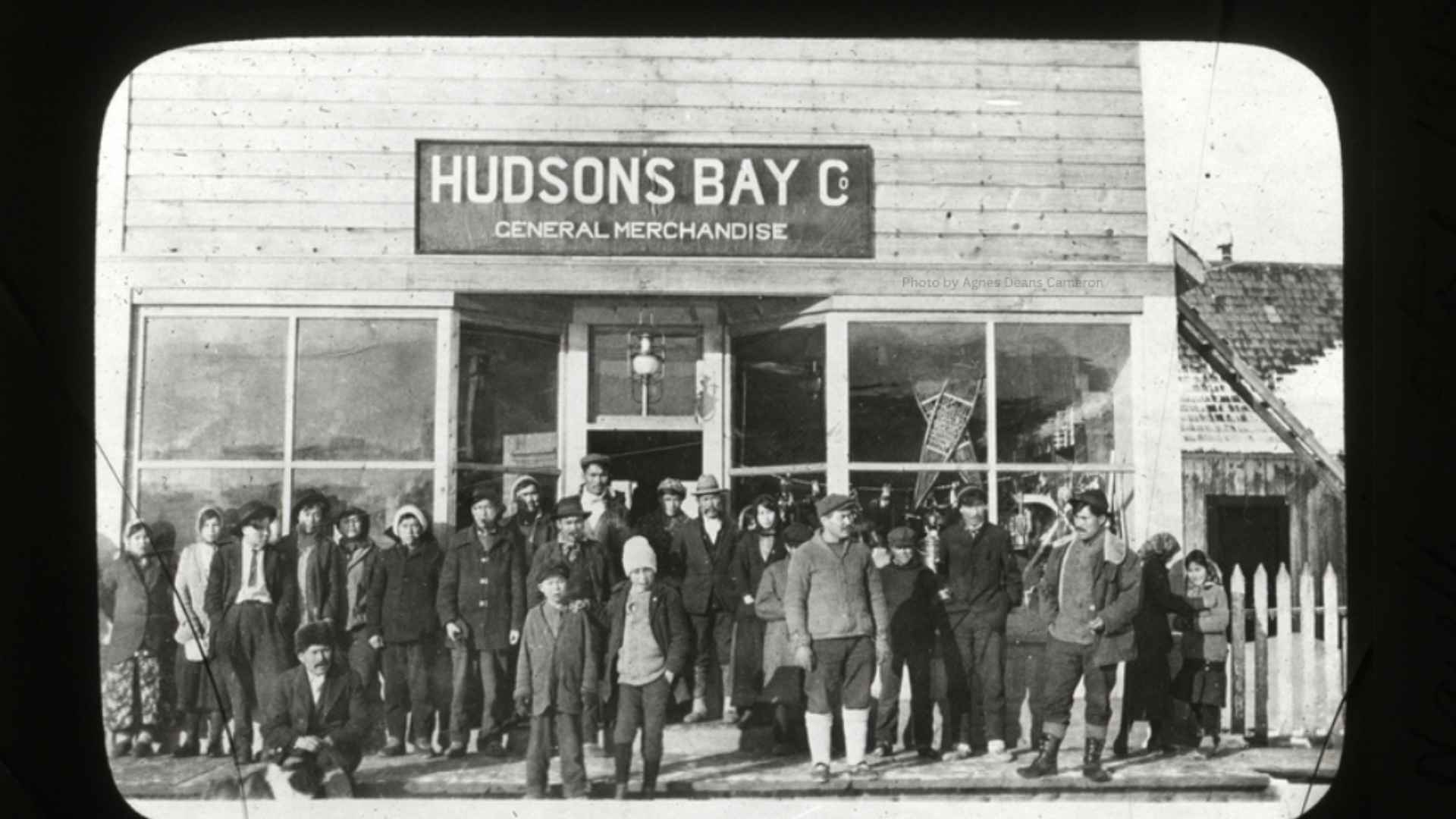

A quick look at the 355-year journey of Hudson’s Bay Company from fur monopoly to mall mainstay

Born out of beaver pelts and royal charters, HBC controlled territory larger than modern Canada before reinventing itself as a department-store chain. The pivot worked for a century, but online shopping and pandemic shutdowns drained sales that brick-and-mortar renovations couldn’t plug. Below is a whirlwind timeline of the company’s milestones.

| Year | Milestone |

|---|---|

| 1670 | Chartered by King Charles II; launches the North American fur trade. |

| 1849 | British court ends its territorial monopoly, forcing diversification. |

| 1960-1990s | Expands into suburban malls, supermarkets, and discount banners. |

| 2025 | Seeks Chapter 11 protection with just six U.S. stores left. |

Think about it—how many brands survive three and a half centuries? Not many.

How shifting consumer habits pushed the historic retailer toward an inevitable bankruptcy spiral

Free two-day shipping, smartphone checkout, and pandemic safety fears reshaped retail. While competitors poured billions into e-commerce, HBC’s online platform stayed clunky, and store updates lagged. Traffic collapsed 44 percent between 2019 and 2024, according to court filings, while debt ballooned above $1 billion.

Add rising interest rates and you’ve got a perfect storm. Still hoping for a last-minute rescue? So are the 2,300 remaining employees. These are the important deadlines and what remaining Hudson’s Bay customers should do right now before liquidation hits:

- Use gift cards immediately: Merchants rarely honor them after liquidation.

- Check return policies: Court approvals may shorten the standard 30-day window.

- Watch the auction docket: A stalking-horse bidder could emerge by April 15.

- Contact benefits administrators: Laid-off staff must file COBRA forms within 60 days.

- Sign up for creditor notices: Suppliers need to file claims before the bar date, likely mid-June.

If you’re a landlord, tenant negotiations could get messy; keep an eye on rejected leases. Consumers? Expect clearance sales but limited sizes—blink and you’ll miss them.

Unless fresh capital arrives, the judge will convert the case to Chapter 7 and order liquidation. That decision could land the week of May 6. Should that happen, Hudson’s Bay will shift from living institution to museum exhibit—a cautionary tale that even 355-year legacies can be out-clicked.