Fewer delays, less fraud: Treasury favors electronic solutions.

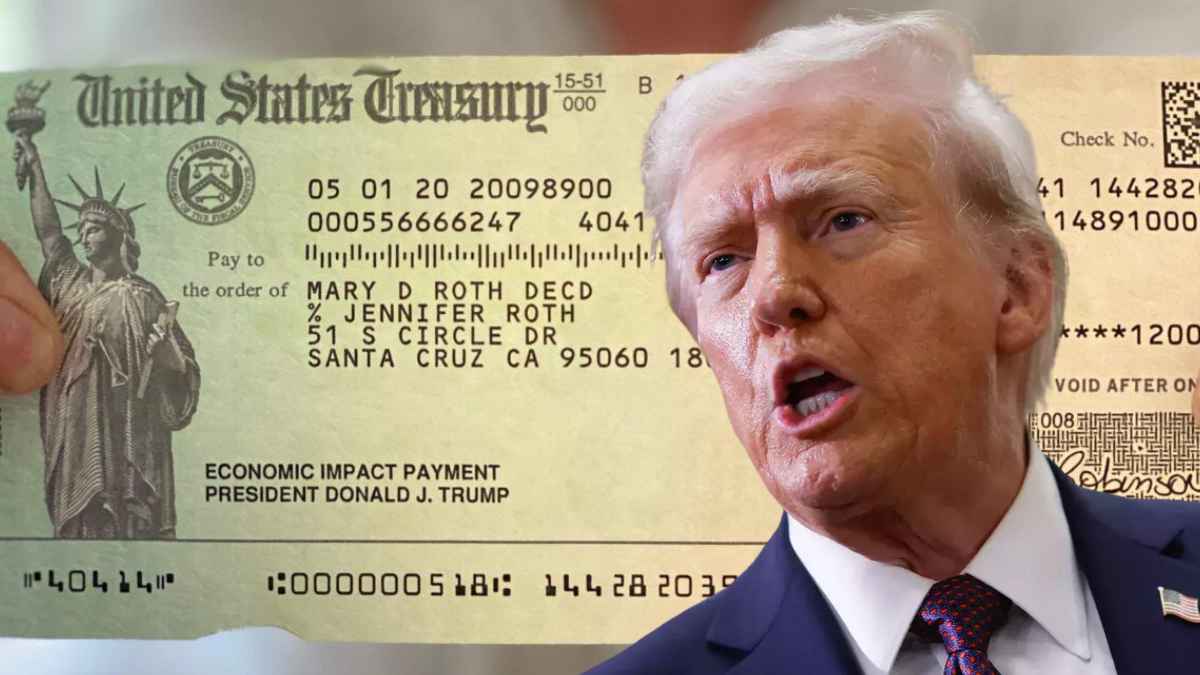

The Trump Administration has issued a directive that could make this year the last time you mail a check to the Internal Revenue Service (IRS) or receive a paper refund. Announced on March 25, the executive order requires federal agencies to fully transition to electronic payment methods by September 30, 2025, with the aim of reducing fraud and modernizing outdated systems.

Under the new order, the Treasury Department, including the IRS, must stop issuing paper checks for all federal disbursements, including tax refunds. Similarly, taxpayers will have to pay any balances owed electronically instead of sending paper checks by mail. Administration officials have pointed out that Treasury checks are significantly more likely to be lost or stolen than electronic transfers, leading to increased security concerns and unnecessary mailing costs.

Key exceptions for taxpayers who cannot access or prefer not to use electronic payments

Will the elderly be forced to go digital even if they don’t like online banking? The answer is generally yes, although exceptions could apply. According to the order, certain exceptions will be made for people without bank accounts or who face specific difficulties.

Situations involving natural disasters or police activities could also warrant an exemption. However, the government’s overall goal remains the elimination of paper-based systems in favor of electronic alternatives.

What are important dates, digital wallets and direct deposits?

Taxpayers should be aware of some key deadlines and options:

- September 30, 2025: deadline set by executive order for agencies to switch.

- Direct deposit: recommended by tax professionals and widely considered the most efficient way to receive refunds.

- Debit, credit and digital wallets: Acceptable for paying tax bills, subject to any specific IRS procedures.

- Prepaid debit cards: Often suggested for people without traditional checking accounts.

Looking for an easy way to keep track of important dates? Many experts recommend creating a digital calendar reminder for September 2025, making sure you have updated your IRS payment methods in time. Below is a brief table comparing paper checks to electronic payments:

| Feature | Paper Checks | Electronic Payments |

|---|---|---|

| Risk of Loss or Theft | Higher | Significantly Lower |

| Speed of Processing | Slower (Mail Delivery) | Faster (Direct Transfer) |

| Cost to Taxpayers | Envelope, postage, possible fees | Typically lower or no direct cost |

| Potential for Fraud | Elevated risk of alteration | Reduced thanks to digital authentication |

These contrasts highlight the Treasury’s justification for completely eliminating paper checks.

Challenges and practical measures

Not everyone is comfortable managing finances online. Some seniors and people in rural areas have limited Internet access or face connectivity issues. Experts suggest taking these steps:

- Plan ahead: Sign up for electronic banking well in advance of the deadline.

- Seek help: If you are inexperienced, ask a trusted family member or financial advisor.

- Stay informed: keep an eye out for IRS announcements explaining new payment platforms or special provisions.

Concerns about digital fraud remain, but advocates argue that electronic systems can be more secure if managed properly. The American Bankers Association has expressed support for the change, citing data showing that online transactions carry less risk than paper transactions.

With September 30, 2025, as the deadline for federal agencies to complete this massive transition, both taxpayers and tax professionals should start to stop using paper checks. Proactive measures, such as setting up direct deposit or verifying bank details, will help minimize disruptions when the policy goes into effect. Staying up to date on Treasury and IRS guidelines will be essential in the coming months.